In 2020, the COVID-19 pandemic took everyone, including the IRS, by surprise, and the deadline for filing federal tax payments was moved from the date usual from mid-April to July 15. In 2021, the due date has been pushed back to May 17, 2021. For now, however, it looks like we will be back to the traditional mid-April due dates.

SummaryTax credits related to the pandemicHow do I declare online?How do I pay online?How do I get my refund?In fact, since the tax deadline cannot be the same day as a holiday, most of us have until April 18th (April 15th is Emancipation Day in DC). If you live in Maine or Massachusetts, you actually have until April 19 because of Patriots Day. Need an extension? After requesting this extension, you have until October 17.

However, the IRS has also advised that the pandemic is still slowing down certain operations, such as the processing of paper-filed returns. Therefore, it might not be a bad idea to start working on those taxes as soon as possible – and submit them online. In fact, whether you're a full-time worker dealing with a single 1040 or a freelancer/gig worker receiving a streak of 1099s, the fastest way to pay the piper these days is to do it online.

If you're a parent who received the Child Tax Credit monthly advance, which was worth up to $300 per month and was offered from July to December 2021, you already know that it was not carried over into 2022. However, be aware that the maximum child credit for 2021 has been increased to $4,000 (depending on your income), and you will be able to claim the amount you did not receive. Didn't follow? You should receive letter 6419 from the IRS telling you how much they have already sent you. You can find more information on this FAQ or check your payments here.

As the third of the Economic Impact Payments is released in 2021, you should receive letter 6475 informing you of the amount you have received. If you didn't receive a payment, but feel you qualified, you can still claim a recovery rebate credit.

There are, of course, many other tax quirks to be aware of, such as the expansion of the Earned Income Tax Credit and a charitable tax deduction for those who don't not detail. Your best bet is to either check the IRS Tax Tips Page or consult an accountant.

The IRS offers a series of instructions on its website to help US citizens calculate their taxes, file them, and send payments (or request refunds) using their online e-filing method. Here's an overview of what's available and where you can find it.

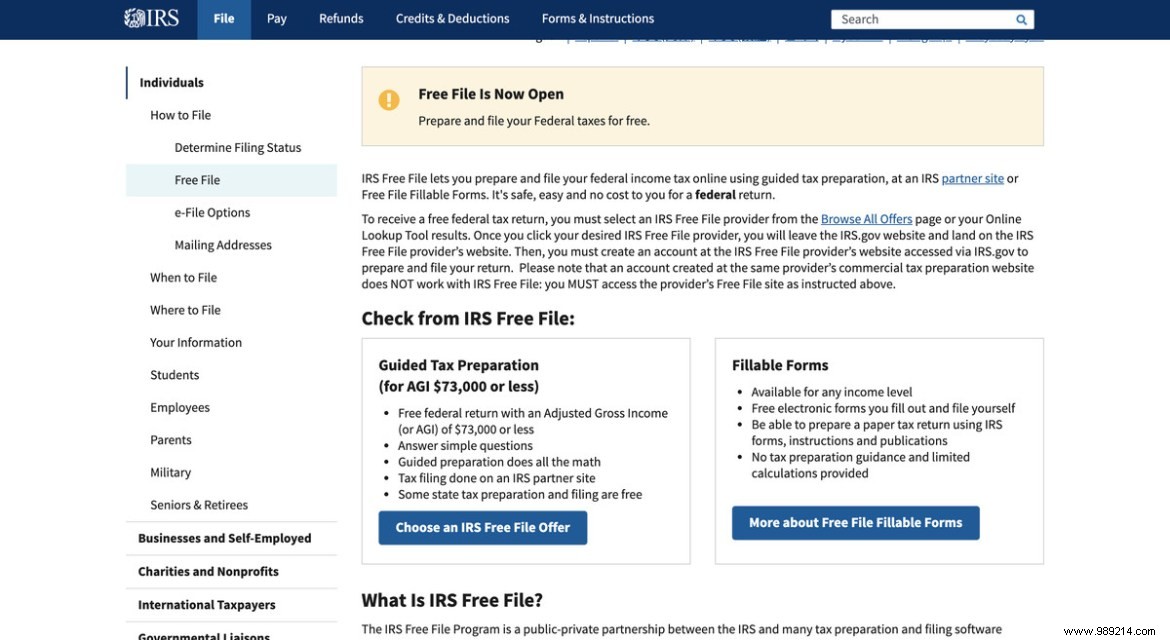

There are several ways to file a return online, depending on your income and your level of comfort with the whole income tax process.

If your adjusted gross income was $73,000 or less, you can use the IRS Free File Option. The site offers a number of third-party services that can help you build and file your taxes for free. Of course, this assumes that the third party is not trying to rip you off into paying more than necessary; in April 2019, ProPublica revealed that TurboTax and other providers deliberately hide the pages of their free services in order to convince taxpayers to purchase additional features. As a result, in early 2020, the IRS issued rules prohibiting these practices. However, it is better to be careful.

If your income is over $73,000, you can still use the fillable forms provided by IRS Free File, but you don't have free software support and you can't pay your taxes by this method. Forms will be available from January 24. (If you really want to do your own taxes, you might want to check out the IRS Tax Tips page, which includes how to handle things like gig economy income.)

If you're not a pro at filing taxes, you'll either need to use e-file with one of the software solutions available, or find a tax preparer who can do it for you. For those with incomes of $58,000 or less, the IRS offers a program called Volunteer Income Tax Assistance (VITA) to help with tax preparation; there is also a Tax Council for the Elderly (TCE) for those aged 60 or over. the page describing these programs has a locator tool so you can find one of these sites near you; given the current pandemic, it is likely that much of the assistance will be by phone or videoconference.

If you use a tax preparer, the person or company doing your taxes must be authorized to use e-file; if you do not yet have a tax specialist, you can find one on the IRS website.

The IRS lists a variety of ways you can pay your taxes online.

If you use tax preparation software or have your returns prepared by a tax professional, you can instruct the IRS to withdraw the funds directly from your bank account through the Electronic Payments System federal tax (EFTPS) at the same time you file. Be aware that according to the IRS, processing a new registration can take up to five business days.

You can also use IRS Direct Payment to withdraw funds from a savings or checking account. Finally, you can use a credit or debit card; however, there are fees involved (since the IRS will not absorb what your credit card company charges for the service). In fact, if you're using a credit card, you may need to add up to 1.98% of your payment amount.

One of the ways the IRS tries to convince you to file online is to make sure you get your refund faster – in less than 21 days, in most cases. cases, although there are exceptions. Once you have deposited, you can check the status of your refund online. You can also download the official IRS2Go mobile app, which lets you check your refund status, pay taxes, and get other information.