The card's other features are very much like what you'd expect from an Apple financial product:simple, private, secure, user-friendly, and only available to iPhone users. It's another step from tech companies into the financial industry, and with features like virtual card numbers, private transactions, and no fees at all, its release (summer 2019) seems like a positive start for the trend.

If you've ever used Apple Pay, you've got a pretty good idea of how the Apple Card works, as it's basically a card optimized for use with iPhones. You make purchases either by tapping your phone on a payment terminal and authenticating with Touch or Face ID, or using the physical card's magnetic stripe or chip (no authentication required for this).

The Secure Element, the encrypted chip where Apple stores your Apple Pay data in an iPhone, is where your actual card data resides. When you get your card, what you really get is a secret ID that's locked away there, invisible even to you. This device number, plus a one-time 3-digit security code (the CVV, essentially) are required to authorize purchases.

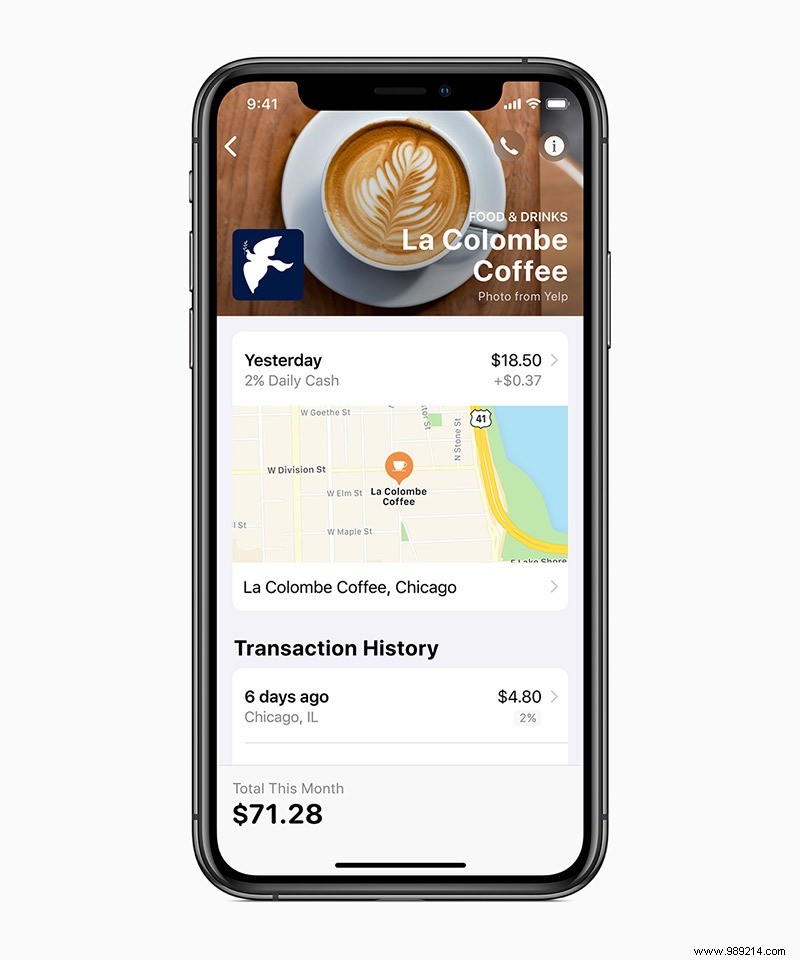

To activate the physical card, you need to tap it against the iPhone, but it doesn't get your secure device number — it has another number you don't know. If the physical card is ever compromised, Apple lets you lock it and request a new one (for free) from within the app. Plus, if you suspect fraud, Apple makes it easy to backtrack and verify your transactions (you can even see the locations on the map) in case their fraud detection algorithms haven't detected anything yet. P>

Worried that Apple is selling this transaction and location data? Dont be. Apple encrypts all of your activity so they don't know what you bought, where you bought it, or how much you paid for it, while still giving you access to it all. Goldman Sachs, the bank Apple works with to issue the card, may see some of this data, but has a strong confidentiality agreement which means none of your data will be sold or shared with third parties.

The short answer here is “yes”. Obviously, it's not the best map for everyone, but it's competitive. Here is what it offers:

As with normal cards, you will need to apply and have your credit score checked, and you will have a credit limit that depends on your history. And while there are technically no late fees, you'll be hit with higher interest rates if you miss a payment, although that's pretty lenient compared to most banks.

>The money management features are also a nice bonus. Not only does Apple introduce various payment plan options to help users pay as little interest as possible and build good habits, but it also provides excellent spending analytics, using machine learning and Apple Maps to label your transactions correctly and give you detailed access to your expenses. history and habits.

Do you have an iPhone (with a newer iOS version)? Are you a US citizen over the age of 18? Do you have a decent credit history? If so, there's really no reason not to try out the Apple Card when it comes out. Worst case scenario, you take a small hit to your credit score and end up with a card on your phone that you never use.

However, you'll also get a great titanium card that I suspect you can use as some sort of tool or barter item in case the apocalypse strikes. It's a free card from a stable company that doesn't mess up your data, so you don't take much risk. As always, however, you must consider your financial needs and assess whether this is the right decision for you.