In 2010, two pizzas from Papa John cost 10,000 Bitcoins – around 41 US dollars. Today, a purchase of $41 would only cost a tiny fraction of a bitcoin (0.0390 in August 2019), and 10,000 bitcoins could be worth well over $100 million (or much less, depending on the day) . Storing your money in cryptocurrency can be a real rollercoaster ride, which is why stablecoins have become increasingly popular over the past few years.

Stablecoins are cryptocurrencies designed specifically to prevent large changes in their value, usually by linking to another asset, such as the US dollar or gold. This makes them much more predictable than Bitcoin or altcoins, which makes buying pizza much less likely to cost you future millions of dollars. However, not all of them work the same way and stability does not necessarily mean security.

If you know of only one stablecoin, it's probably Tether or TrueUSD. These and several others, like Paxos Standard, Gemini Dollar, and even Libra are “fiat-backed,” meaning that for every unit of cryptocurrency issued on these blockchains, a certain amount of national currency (dollar, euro , pound, yen, etc.) is stored somewhere. For each TrueUSD token, for example, there is one US dollar in an account for which the token can be exchanged at any time.

Of course, storing real assets somewhere is also not without risks, as the company may lie or the assets may be damaged or devalued in some way.

Yes, create a stablecoin backed by an unstable Asset sounds a bit crazy, but even if it gets quite complicated, it can work. Take Dai, which is pegged to the US dollar and depends on Ethereum for its value. It “over-collateralizes” by forcing you to deposit more Ethereum than you get in Dai, which will be sold if the value of Ethereum threatens to drop below the dollar value of your Dai. For example:

It's a complex system with many more twists, turns and exceptions, but it works and has the advantage of being decentralized.

It is probably the most complex type of stablecoin (and perhaps the least popular), as it is not based on anything at all and depends on algorithms to respond to changes in supply and demand in order to maintain its value.

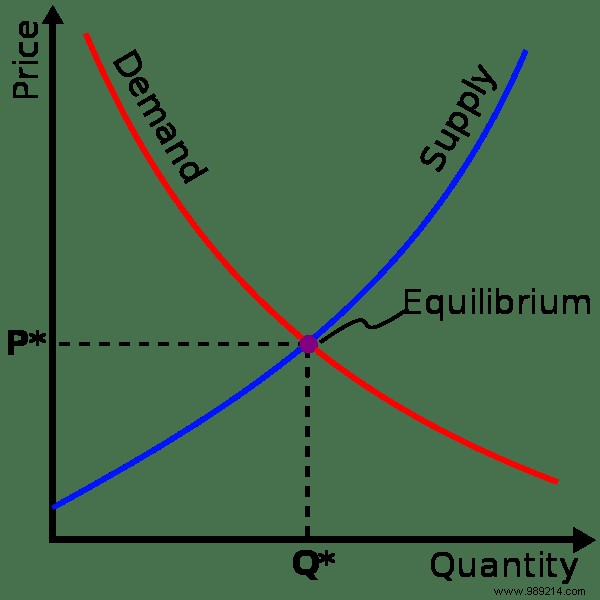

Imagine that one of these coins is worth $1 when stable, but a news article spikes demand and starts selling for $1.10. To drive the price down, the algorithm would mint new coins until supply and demand reached equilibrium at one dollar. Soon, however, people forget about the coin and demand drops, leaving the price at $0.9, so the algorithm does the opposite, buying back coins to raise the price. To do this, instead of offering real money to users, it could offer “shares” that promise them a portion of the system's profits in the future.

In one sentence:an algorithm automatically buys and sells coins to keep the price stable. The biggest project, Basis, was shut down due to regulatory issues, but Carbon and several others are still experimenting with the system.

Stablecoins are useful for crypto day traders looking to lock in their earnings overnight, but they're also useful if you want to pay for your coffee without looking at a price chart or send money to someone without the value changes during transaction processing.

Fluctuations in cryptocurrencies are great for speculators, but they make pricing, lending, and long-term commitments much more difficult, and getting in and out of stable national currencies comes with its own set of problems. Of course, you can just buy US dollars, but turning them into Bitcoin can be a bit of a process. A stablecoin worth a dollar travels much more easily through the crypto space and can act as an easily accessible store of value in an otherwise crazy world.

Image credits:Scale of Justice, Supply-Demand Balance, Gold Bars